Vietnam E-bike Market Size, Share, Trends and Outlook Report 2033

- Rahul Pal

- Dec 8, 2025

- 4 min read

Market Overview

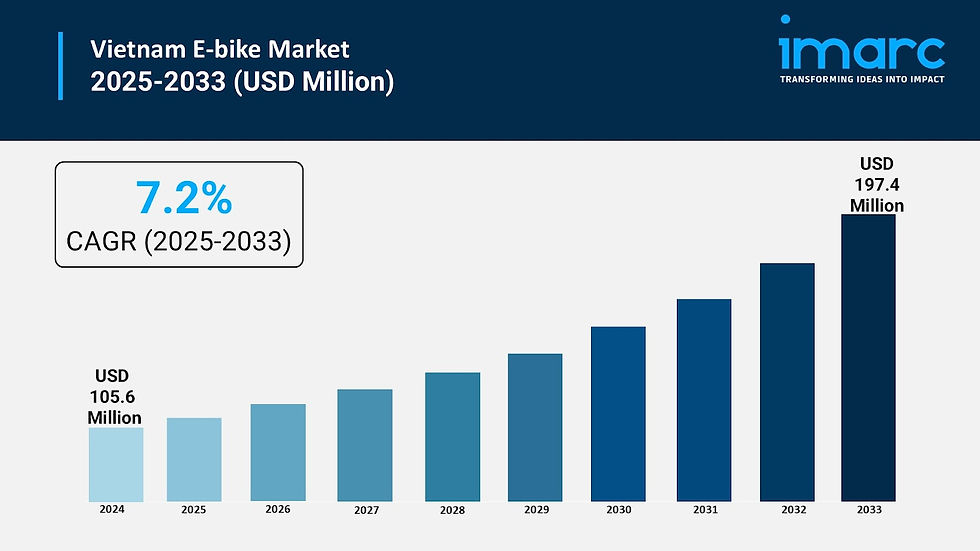

The Vietnam E-bike market size was valued at USD 105.6 Million in 2024 and is projected to reach USD 197.4 Million by 2033, growing at a CAGR of 7.2% during the forecast period of 2025-2033. Key growth drivers include the need for sustainable alternatives to conventional motor vehicles, government incentives for eco-friendly transportation, and technological advancements in battery and motor efficiency.

Study Assumption Years

Base Year: 2024

Historical Year/Period: 2019-2024

Forecast Year/Period: 2025-2033

Vietnam E-bike Market Key Takeaways

Current Market Size (2024): USD 105.6 Million

CAGR (2025-2033): 7.2%

Forecast Period: 2025-2033

The rising environmental consciousness and rapid urbanization in Vietnam are key factors increasing e-bike demand.

Government initiatives and subsidies make e-bikes more affordable and promote sustainable transportation.

Improved battery technology and the development of charging infrastructure enhance e-bike usability.

Challenges include limited access to charging stations, poor road conditions, and lack of awareness about e-bike benefits.

Urban commuters face traffic congestion, making e-bikes a convenient and cost-effective transport alternative.

Sample Request Link: https://www.imarcgroup.com/vietnam-e-bike-market/requestsample

Market Growth Factors

The Vietnam e-bike market is driven significantly by rising environmental consciousness and governmental support. Vietnam faces severe air pollution, especially in major cities, which fuels demand for zero-emission alternatives like e-bikes. Government incentives include subsidies for e-bike purchases, reduced import duties, and VAT exemptions, making these vehicles more affordable. For example, as of March 1, 2022, EV excise tax rates were lowered by up to 12%. The government also undertakes awareness campaigns highlighting economic and environmental benefits. These initiatives notably boost the market's growth.

Increasing environmental concerns among individuals further propel market growth. Vietnam’s commitment to reducing greenhouse gas emissions as a Paris Agreement signatory targets a 15.8% emissions cut by 2030, encouraging the shift to electric vehicles including e-bikes. The government’s introduction of stricter emission standards (Euro emission five from January 2022) and plans to phase out fossil fuel vehicles by 2040 are vital. The goal is zero net greenhouse gas emissions by 2050, with all motor vehicles running on electricity or alternative energy, which directly supports e-bike adoption.

Infrastructure development plays a critical role in market expansion. The Vietnamese government and private sector investments focus on expanding charging stations and developing bike-only lanes. For instance, Vinfast launched an EV charging company named V-Green in March 2024. Hanoi’s Department of Transport announced a 4 km bike-only lane in January 2024, facilitating safer and more efficient rides. These enhancements alleviate range anxiety, reduce accidents, and improve the user experience, thus encouraging greater e-bike usage.

Market Segmentation

By Mode:

Throttle: Operates like a motorcycle with a handlebar throttle to control speed without pedaling.

Pedal Assist: Provides motor assistance proportional to the rider's pedaling input for a natural riding experience.

By Motor Type:

Hub Motor: Cost-effective, fewer moving parts, sealed against elements, requiring less maintenance.

Mid Drive: Centrally mounted for better balance and handling; uses bike gears; suitable for hilly terrains and off-road.

Others: Not specified in detail.

By Battery Type:

Lead Acid: Inexpensive, durable, widely available with relatively fast charging times.

Lithium Ion: Popular for high energy density, longer life, lightweight, low self-discharge, and better performance.

Nickel-Metal Hydride (NiMH): Higher energy density than lead acid, environmentally friendly, tolerates overcharging better.

Others: Not specified in detail.

By Class:

Class I: Motor assists only while pedaling and stops assistance at 20 mph.

Class II: Motor can propel the bike without pedaling; ceases assistance at 20 mph.

Class III: Motor assists only when pedaling; stops assistance at 28 mph (45 km/h).

By Design:

Foldable: Portable and compact for easy storage and multi-modal commuting.

Non-Foldable: Typically more powerful with larger motors and batteries; better stability and longer range.

By Application:

Mountain/Trekking Bikes: Designed for off-road with durable frames, wide tires, and suspension systems.

City/Urban: Suitable for commuting, upright riding position, equipped with fenders, lights, and racks.

Cargo: Built for heavy loads with sturdy frames and cargo racks or boxes.

Others: Not specified in detail.

By Region:

Northern Vietnam: High demand due to traffic congestion in cities like Hanoi and Haiphong.

Central Vietnam: Moderate demand influenced by tourism and urbanization in cities like Hue, Danang, Hoi An.

Southern Vietnam: Significant demand in Ho Chi Minh City and other urban centers with rapid urbanization.

Regional Insights

Northern Vietnam, including congested cities like Hanoi and Haiphong, emerges as a dominant market due to high demand for maneuverable e-bikes in crowded urban areas. Central Vietnam experiences moderate demand driven by tourism and infrastructure development, while Southern Vietnam sees significant adoption in rapidly urbanizing cities like Ho Chi Minh City. These regional dynamics underscore the broad growth potential across Vietnam's diverse markets.

Recent Developments & News

March 2024: Vinfast launched V-Green, an EV charging station company, enhancing the charging infrastructure for electric vehicles including e-bikes.

January 2024: Hanoi Department of Transport announced a 4 km bike-only lane along To Lich River to improve safety and convenience for bicycle and e-bike users.

November 2023: Dat Bike, a domestic electric two-wheeler manufacturer, introduced its first electric scooter, marking diversification in the electric two-wheeler market.

Key Players

Vinfast

Dat Bike

Customization Note

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302

Comments